45 bond yield vs coupon rate

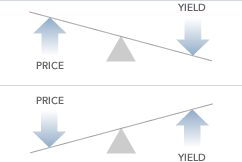

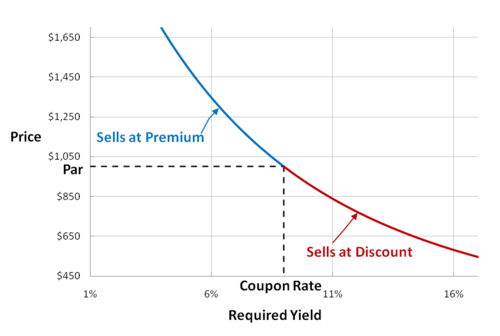

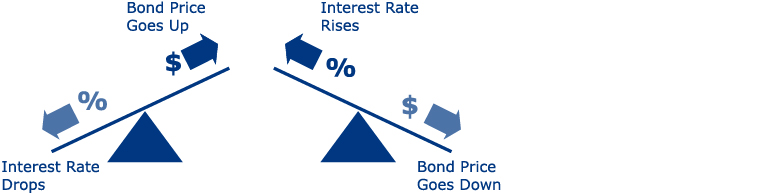

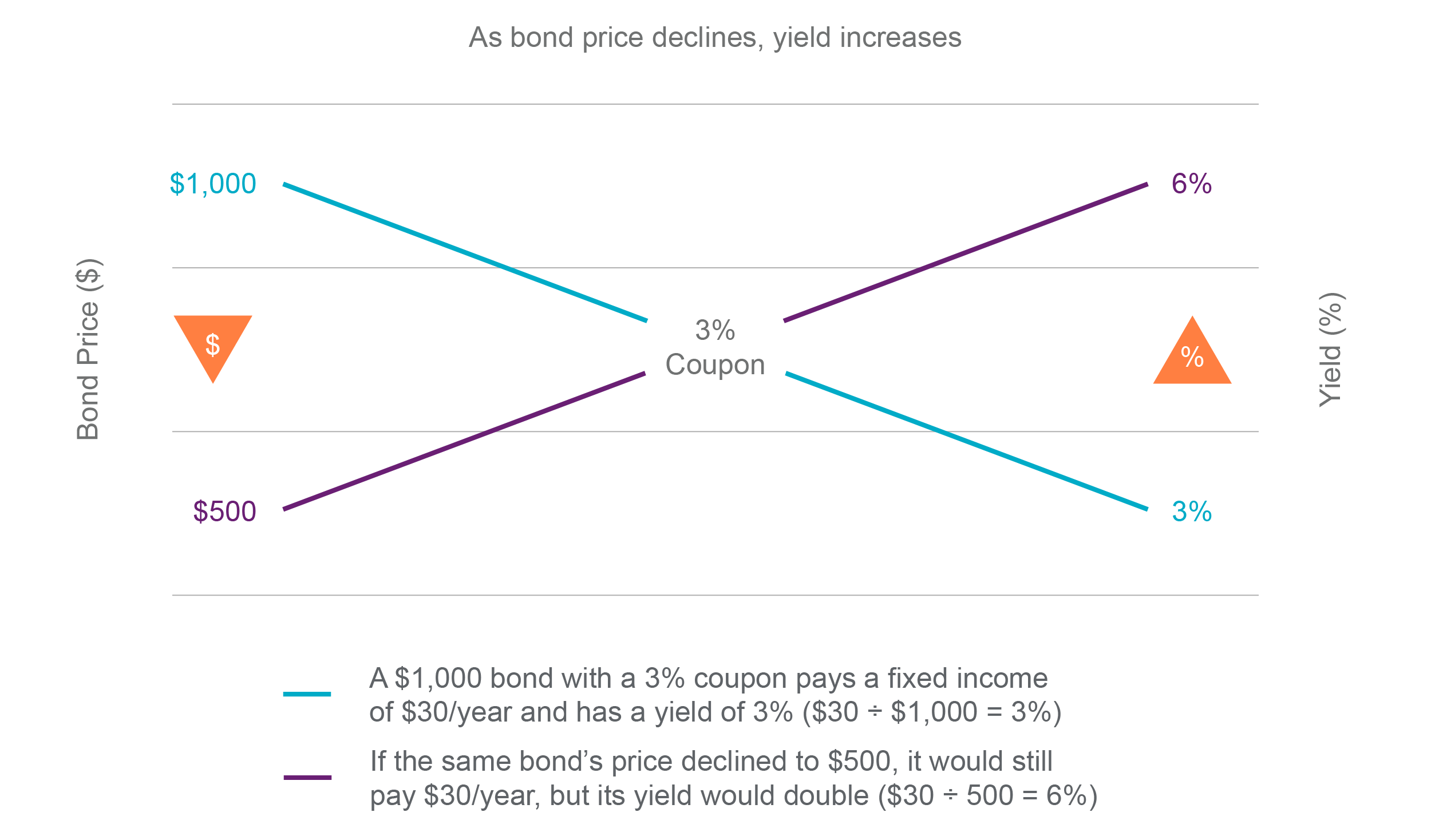

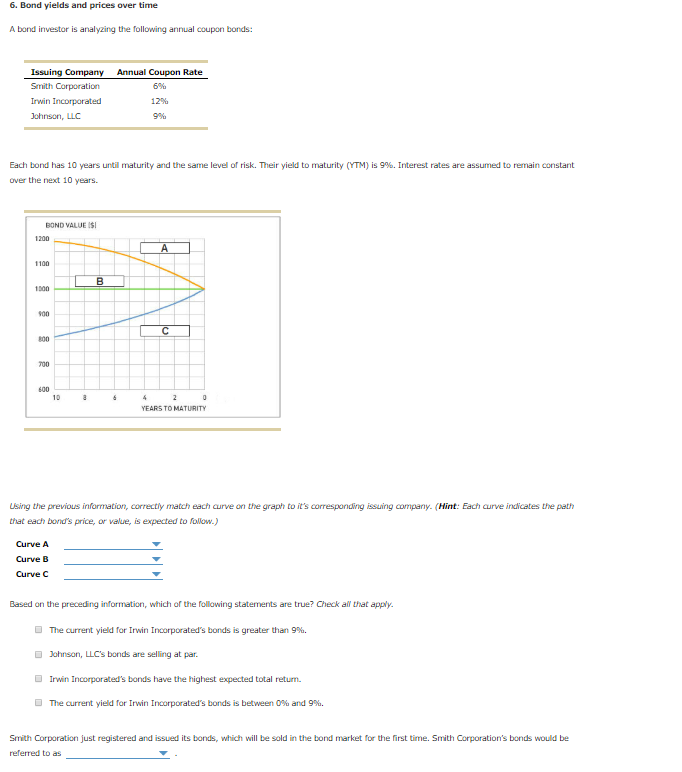

How are bond yields different from coupon rate? The coupon rate is often different from the yield. A bond's yield is more accurately thought of as the effective rate of return based on the actual market value of the bond. At face... Bond Basics: How Interest Rates Affect Bond Yields The relationship between a bond's current price and its coupon is known as its yield, which is the amount of return an investor will realize on a bond, calculated by dividing its face value by its coupon. As market conditions affect a bond's price, its yield will also change. For example: As Bond Price Declines, Yield Increases

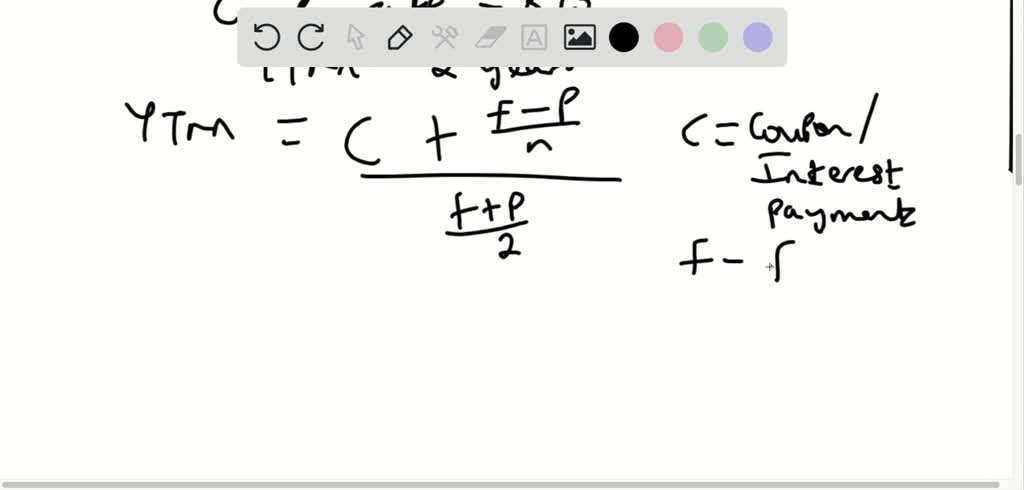

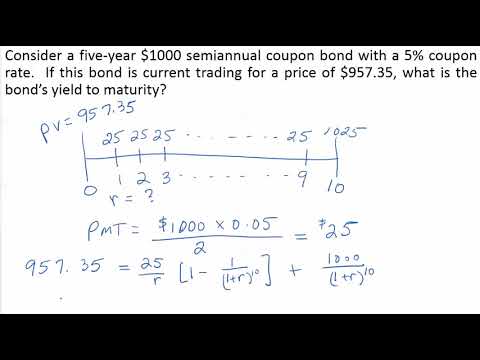

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The coupon rate is the annual income an investor can expect to receive while holding a particular bond. At the time it is purchased, a bond's yield to maturity and its coupon rate are the...

Bond yield vs coupon rate

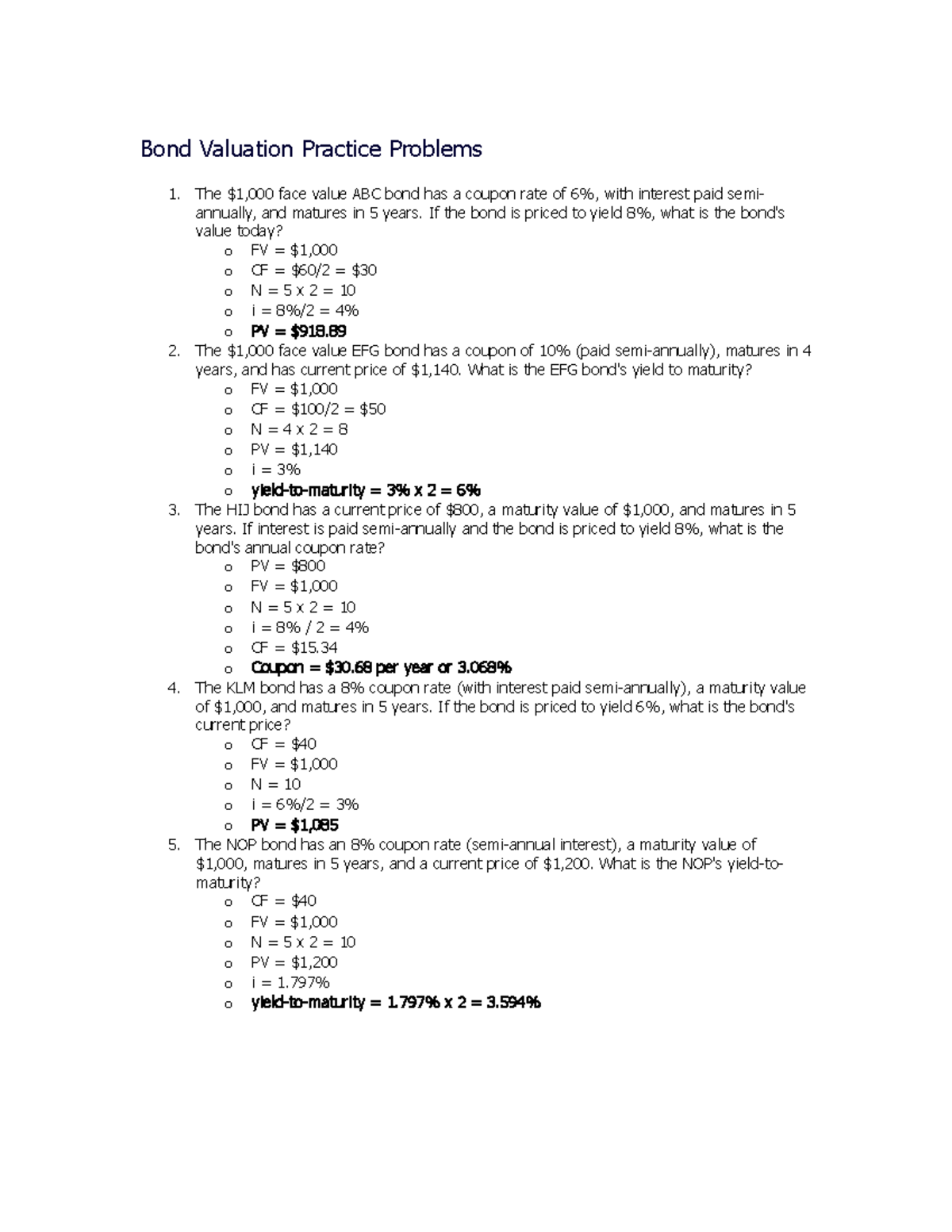

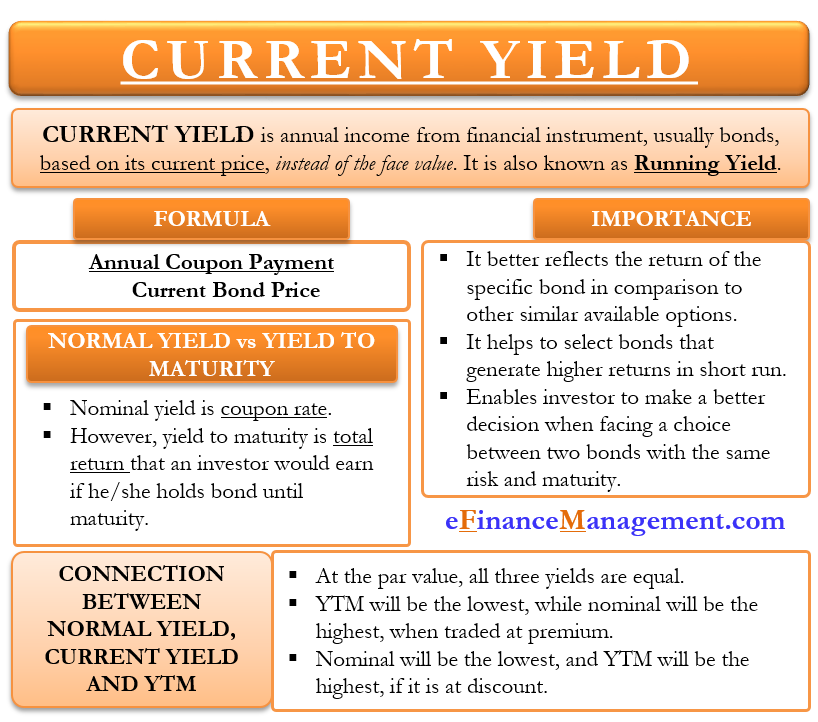

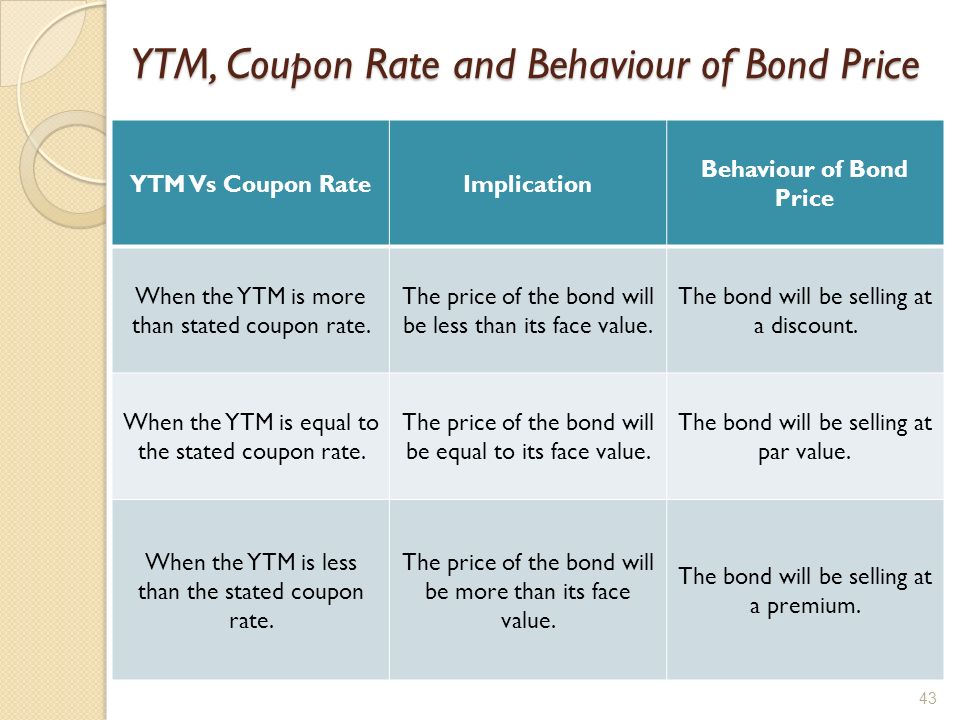

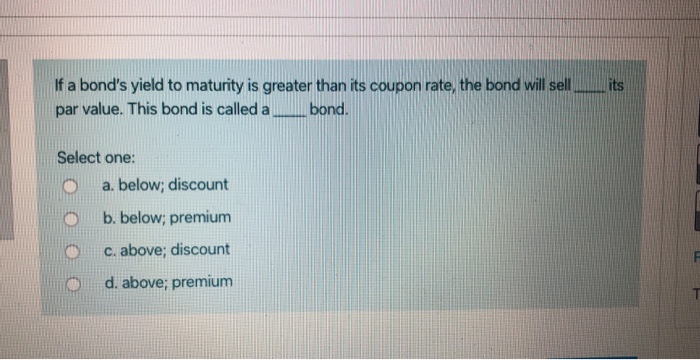

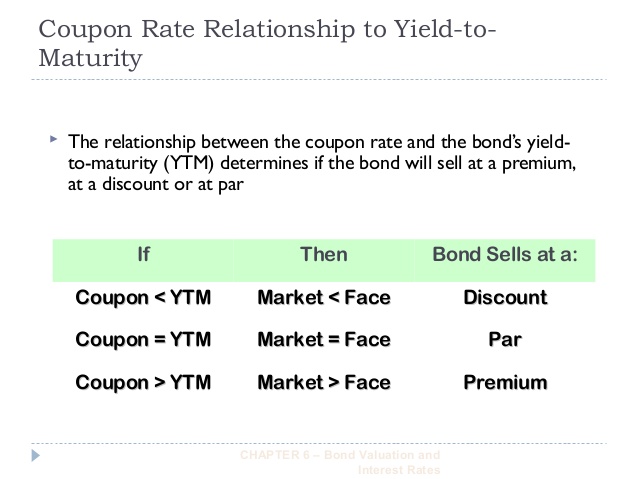

Coupon Rate vs Yield Rate for Bonds | Wall Street Oasis Yield can be different than coupon rates based on the principal price of the bond. If the price is par at time of purchase and you receive par at maturity, then the yield and coupon will be the same. However, if you buy at a discount, say at 90 instead of 100, and receive 100 at maturity, all the while still receiving 10 (10% on principal of ... Difference Between Current Yield and Coupon Rate The main difference between the current yield and coupon rate is that the current yield is just an expected return from a bond, and the coupon rate is the actual amount paid regularly for a bond till it gets mature. The Current Yield keeps changing as the market value of the bond changes, but the Coupon Rate of a particular bond remains the same. Of coupons, yields, rates and spreads: What does it all mean? - YieldStreet At inception, the bond's yield is equal to its coupon, because the bond price is at par, or at 100% of the face value. So at issuance it has a 5% coupon and a 5% yield. Over time, several factors may affect the bond price - for example the issuing company performing poorly, or an increase in the risk-free rate - which would drag the bond ...

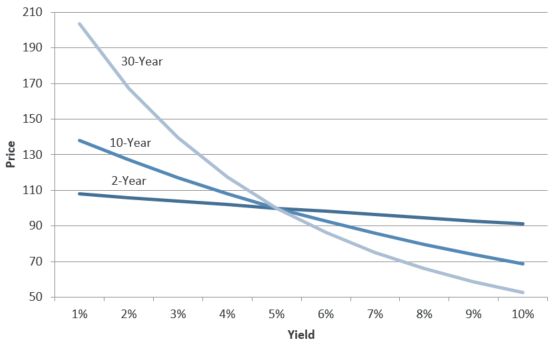

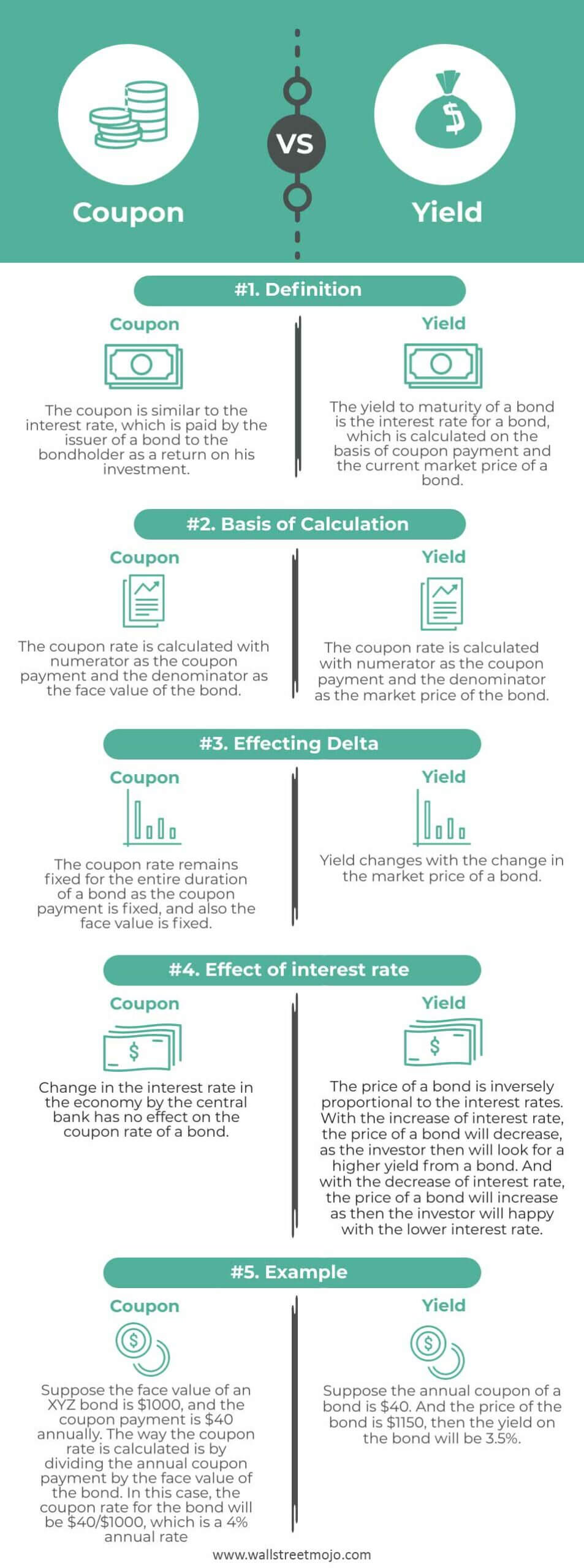

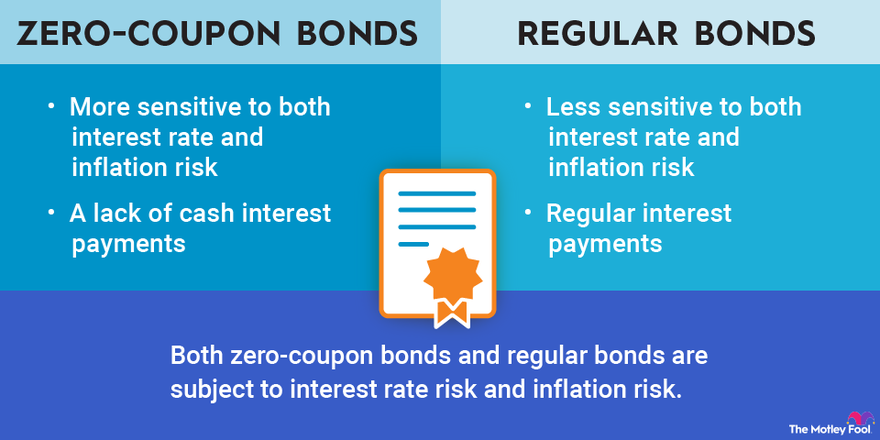

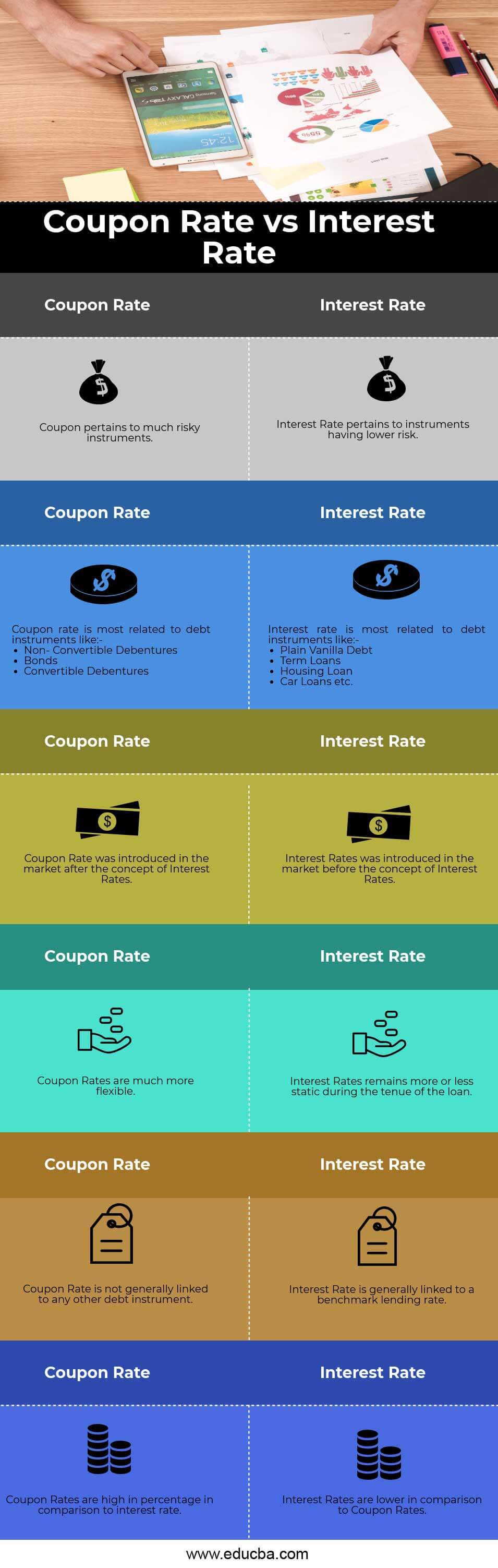

Bond yield vs coupon rate. Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held … Important Differences Between Coupon and Yield to Maturity - The Balance The yield increases from 2% to 4%, which means that the bond's price must fall. Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%). Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) Bonds with low coupon rates will have higher interest rate risk than bonds that have higher coupon rates. For example, consider a bond with a coupon rate of 2% and another bond with a coupon rate of 4%. Keeping all the features the same, bond with a 2% coupon rate will fall more than the bond with a 4% coupon rate. Bond Coupon Interest Rate: How It Affects Price - Investopedia At $715, the bond's yield is competitive. Conversely, a bond with a coupon rate that's higher than the market rate of interest tends to rise in price. If the general interest rate is...

Coupon Rate vs Yield for a Bond: Fixed Income 101: Easy Peasy ... - YouTube Coupon Rate vs Yield for a Bond: Fixed Income 101: Easy Peasy Finance for Kids and Beginners 17,843 views May 30, 2019 This video addresses "Coupon Rate vs Yield" for a Bond in... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. Bond Yield Rate vs. Coupon Rate: What's the Difference? Thus, a $1,000 bond with a coupon rate of 6% pays $60 in interest annually and a $2,000 bond with a coupon rate of 6% pays $120 in interest annually. Key Takeaways. Coupon rates are the yields associated with regular interest payments made by bonds and are influenced by prevailing interest rates. A bond's yield is the rate of return the bond ... Coupon vs Yield | Top 8 Useful Differences (with Infographics) - EDUCBA The coupon amount is the amount that is paid out semi-annually or annually till the maturity date on the face value of the bond. While current yield generates the return annually depend on the market price fluctuation. Coupon rates are more likely influenced by the interest rates fixed by the government body on the basis country's economy.

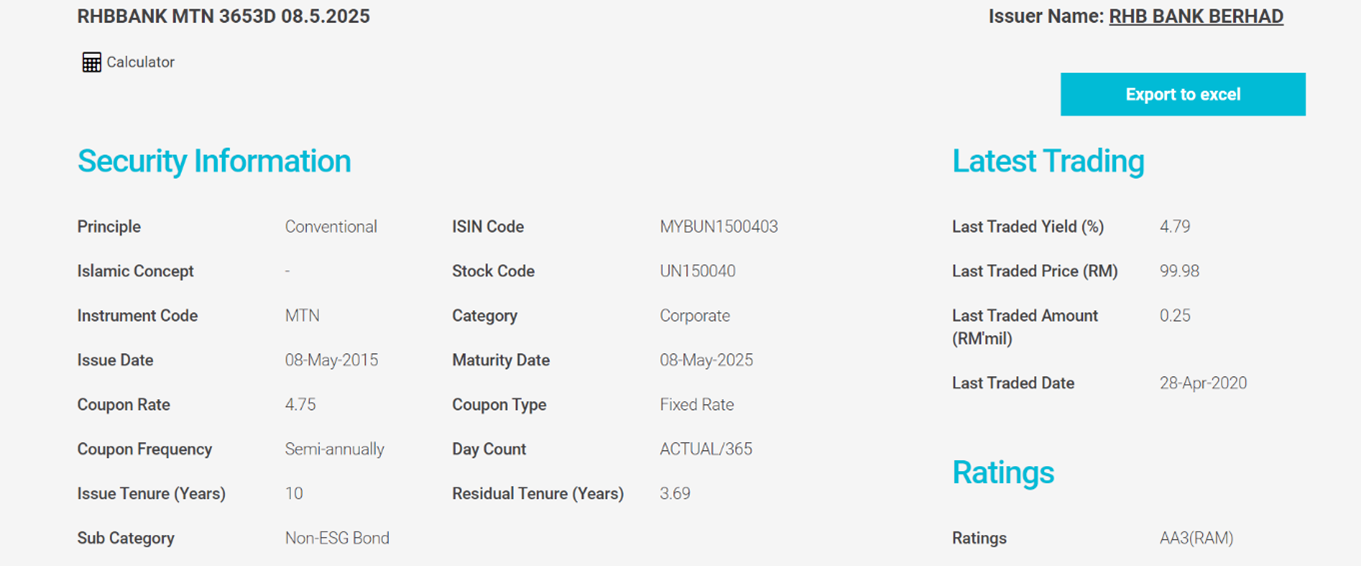

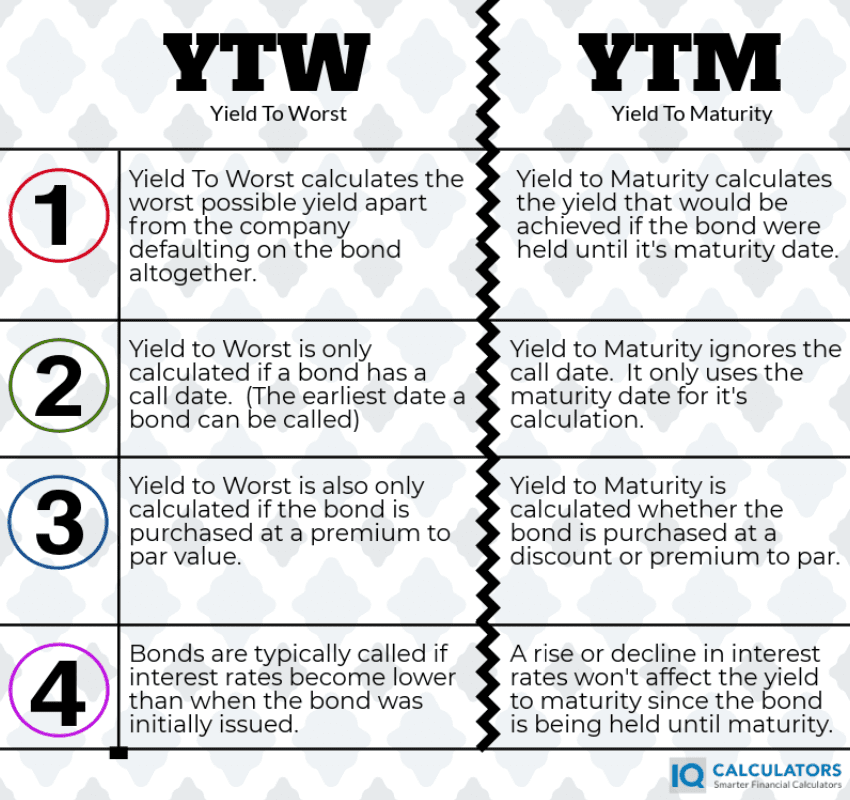

Key Differences: Bond Price vs. Yield - SmartAsset To compensate for that, corporations issuing bonds at a lower rate must offer buyers a discount. Bond Price and Interest Rate Example. Let's say you purchase a bond from ABC Corp. that comes with a coupon rate of 5%. Three possibilities follow: The prevailing interest rate stays the same as the bond's coupon rate. Bond Yield Rate vs. Coupon Rate: What's the Difference? There are differences between a bond's yield rate and its coupon rate. The coupon rate influences market price and the market price influences yield. Education General Dictionary Economics Corporate Finance Roth IRA Stocks Mutual Funds ETFs 401(k) Investing/Trading When is a bond's coupon rate and yield to maturity the same? - Investopedia The coupon rate is often different from the yield. A bond's yield is more accurately thought of as the effective rate of return based on the actual market value of the bond. At face... Understanding Coupon Rate and Yield to Maturity of Bonds When bonds are initially issued in the primary market, the Coupon Rate is based on current market rates, hence YTM is equal to the Coupon Rate. In the example bond above, when you bought the 3-year RTB issued at the primary market, your YTM and Coupon Rate is 2.375%. Now, what if you bought the security in the secondary market?

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a percentage of its par value....

Understanding Bond Prices and Yields - Investopedia A bond's yield is the discount rate that links the bond's cash flows to its current dollar price. A bond's coupon rate is the periodic distribution the holder receives. Although a...

Of coupons, yields, rates and spreads: What does it all mean? - YieldStreet At inception, the bond's yield is equal to its coupon, because the bond price is at par, or at 100% of the face value. So at issuance it has a 5% coupon and a 5% yield. Over time, several factors may affect the bond price - for example the issuing company performing poorly, or an increase in the risk-free rate - which would drag the bond ...

Difference Between Current Yield and Coupon Rate The main difference between the current yield and coupon rate is that the current yield is just an expected return from a bond, and the coupon rate is the actual amount paid regularly for a bond till it gets mature. The Current Yield keeps changing as the market value of the bond changes, but the Coupon Rate of a particular bond remains the same.

Coupon Rate vs Yield Rate for Bonds | Wall Street Oasis Yield can be different than coupon rates based on the principal price of the bond. If the price is par at time of purchase and you receive par at maturity, then the yield and coupon will be the same. However, if you buy at a discount, say at 90 instead of 100, and receive 100 at maturity, all the while still receiving 10 (10% on principal of ...

:max_bytes(150000):strip_icc()/female-executive-talking-to-colleagues-117455512-5750d4d75f9b5892e8b3d3af.jpg)

:max_bytes(150000):strip_icc()/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

Post a Comment for "45 bond yield vs coupon rate"