39 zero coupon bond value calculator

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P ... What Is a Bond Coupon? - The Balance 04/03/2021 · Older bonds with higher bond coupons actually pay more than a bond's maturity value during times of low interest rates. This leads to a guaranteed loss on the principal repayment portion. But it's offset by the higher bond coupon rate. It results in an interest rate close to those being newly issued at the time.

Zero Coupon Bond | Investor.gov Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a ...

Zero coupon bond value calculator

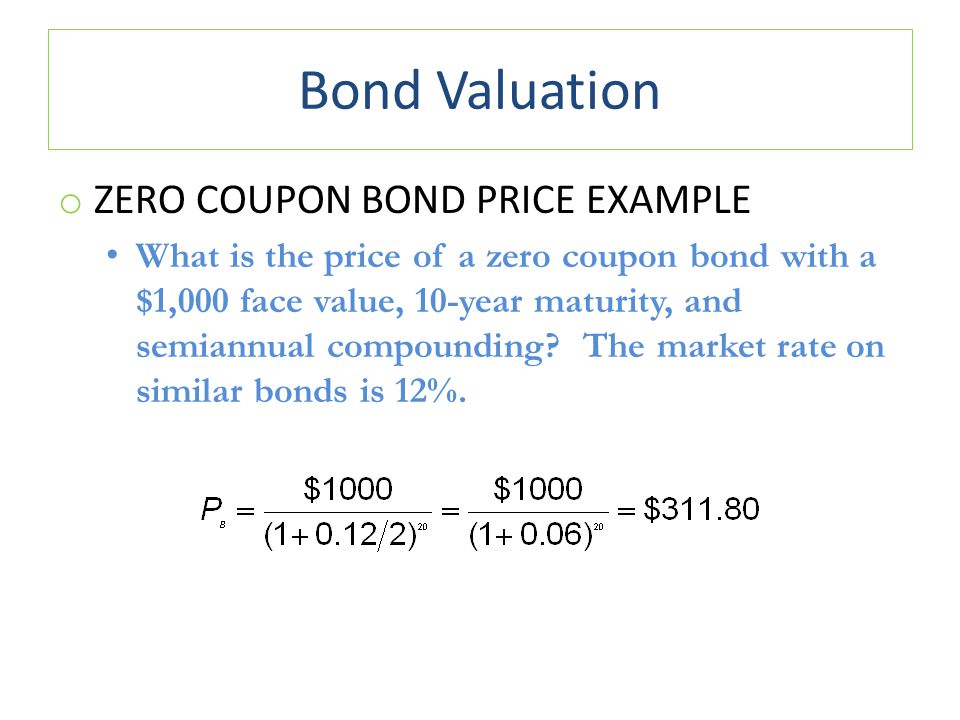

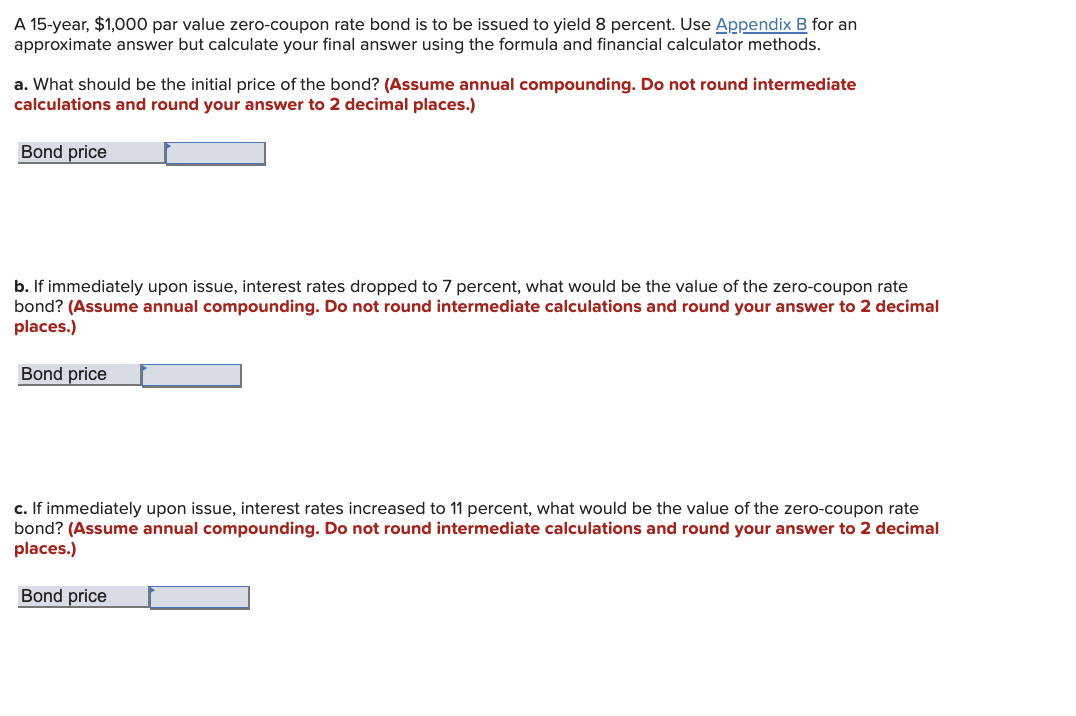

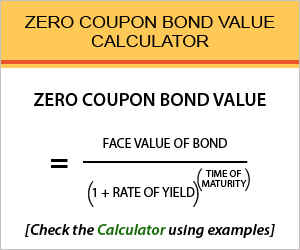

Zero Coupon Bond Calculator – What is the Market Value? So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Zero Coupon Bond Calculator - Nerd Counter There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years. So, the under the given procedure will be applied to have the demanded answer easily: $4000 (1+.3)20; $4000; 190.049637748; $21.05 Bond Price Calculator – Present Value of Future Cashflows - DQYDJ Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures. Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value.

Zero coupon bond value calculator. Publication 550 (2021), Investment Income and Expenses If you cash the bond when it reaches a value of $1,000, you report $500 interest income—the difference between the value of $1,000 and the original cost of $500. Example 2. If, in Example 1 , the executor had chosen to include the $200 accrued interest in your uncle's final return, you would report only $300 as interest when you cashed the bond. $300 is the interest earned … Zero Coupon Bond Value - Formula (with Calculator) - finance … As shown in the formula, the value, and/or original price, of the zero coupon bond is discounted to present value. To find the zero coupon bond's value at its original price, the yield would be used in the formula. After the zero coupon bond is issued, the value may fluctuate as the current interest rates of the market may change. Bond Valuation: Calculation, Definition, Formula, and Example May 31, 2022 · Bond valuation is a technique for determining the theoretical fair value of a particular bond. Bond valuation includes calculating the present value of the bond's future interest payments, also ... Bond Calculator | Calculates Price or Yield How to Use the Bond Calculator Your inputs: Bond price - while bonds are usually issued at par, they are available in the resale market at either a premium or a discount. If a bond is quoted at a discount of $86, enter $86 here. If you enter a '0' (zero) and a value other than 0 for the Yield-to-Maturity, SolveIT! will calculate the Current Price.

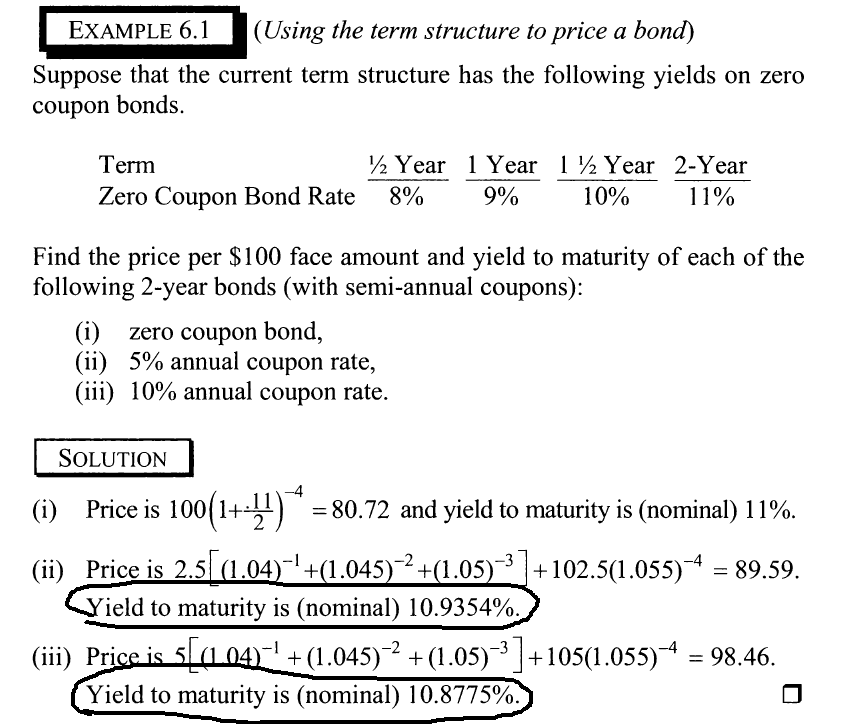

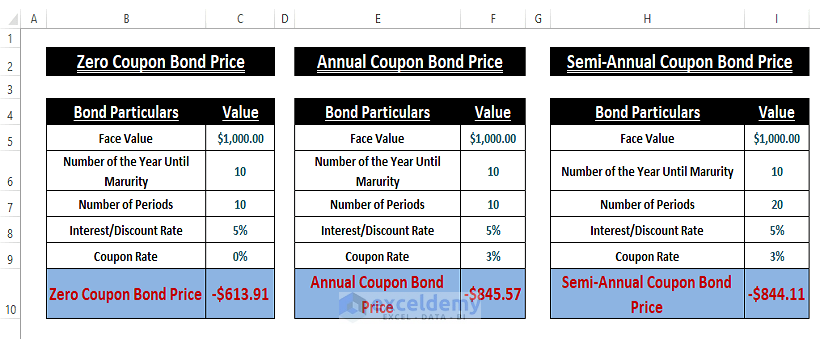

Zero-Coupon Bonds: Characteristics and Calculation Example To calculate the price of a zero-coupon bond – i.e. the present value (PV) – the first step is to find the bond’s future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods. If the zero-coupon bond compounds semi-annually, the number of years until maturity must be ... Bond Price Calculator | FinPricing Zero coupon bond A zero coupon bond is a bond that doesn’t pay interest/coupon but instead pays one lump sum face value at maturity. Typical zero coupon bond is treasury bill. Callable bond A callable bond is a bond in which the issuer has the right to call the bond at specified times from the investor for a specified price. Bond Price Calculator – Present Value of Future Cashflows - DQYDJ Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures. Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value. Zero Coupon Bond Calculator - Nerd Counter There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years. So, the under the given procedure will be applied to have the demanded answer easily: $4000 (1+.3)20; $4000; 190.049637748; $21.05

Zero Coupon Bond Calculator – What is the Market Value? So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator.

Post a Comment for "39 zero coupon bond value calculator"