43 are treasury bills zero coupon bonds

What Are Series EE Savings Bonds? - Forbes Advisor Getty. Series EE bonds are a type of low-risk U.S. savings bond that are guaranteed to double in value after 20 years. Because they are issued by the U.S. Treasury with a 30-year term, they are an ... I've heard various names for government securities; could you simplify ... Bonds with no coupon payments are known as zero coupon bonds 2. They are, however, issued at a discount and redeemed at face value, similar to T- Bills. Capital Indexed Bonds 3 are bonds whose principal is linked to an accepted index of inflation to protect investors' principal from inflation.

Weekly Forecast, August 12, 2022: Negative 2-Year/10-Year Spread ... This week's simulation shows that the most likely range for the 3-month U.S. Treasury bill yield in ten years is from 0% to 1%. There is a 28.69% probability that the 3-month yield falls in this...

Are treasury bills zero coupon bonds

Learn with ETMarkets: These are 4 key players in the bond market Live updates: China's Covid cases ease as Hong Kong sets new rules for inbound travelers calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Disadvantages of Zero-coupon Bonds. There are two major disadvantages of zero-coupon bonds. The first disadvantage is they do not throw off any income as the capital is stored in the bond. In some countries the imputed interest may be taxed as income even though the bond has not yet been redeemed or reached maturity. Domestic bonds: USA, Bills 0% 28jul2022, USD (182D) US912796S595 Domestic bonds: USA, Bills 0% 28jul2022, USD (182D) US912796S595 Download Copy to clipboard Zero-coupon bonds, Bills Issue Issuer JCRA - *** Scope - *** Status Matured Amount 115,229,006,700 USD Placement *** Redemption (put/call option) *** (-) ACI on No data Country of risk USA Current coupon - Price *** % Yield / Duration -

Are treasury bills zero coupon bonds. › articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Zero-coupon U.S. Treasury bonds have a poor risk-return profile when held alone. Long-dated zero-coupon Treasury bonds are more volatile than the stock market, but they offer the lower long-run ... EGP T-Bills EGP Treasury Bill Auction According to the Primary Dealers System. Type (days) 182. 364. Auction date. 11/08/2022. 11/08/2022. Issue date. 16/08/2022. › treasury-bills-vs-bondsTreasury Bills vs Bonds | Top 5 Differences (with Infographics) T-bills do not pay any coupon. They are floated as a zero-coupon bond Zero-coupon Bond In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to its par value and does not pay periodic interest. In other words, the annual implied interest ... › terms › tTreasury Bills (T-Bills) Definition - Investopedia Jun 02, 2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ...

Germany Government Bonds - Yields Curve The Germany 10Y Government Bond has a 0.981% yield. 10 Years vs 2 Years bond spread is 37.6 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 0.50% (last modification in July 2022). The Germany credit rating is AAA, according to Standard & Poor's agency. 30-year TIPS reopening auction is coming Thursday. Any takers? However, the chance of that happening is essentially zero. Inflation breakeven rate. With a 30-year Treasury bond closing Friday with a nominal yield of 3.11%, this TIPS currently has an inflation breakeven rate of 2.21%, which seems in line with historical standards. The market is not forecasting steeply higher inflation over the next three ... iShares 7-10 Year Treasury Bond ETF | IEF - BlackRock The iShares 7-10 Year Treasury Bond ETF (IEF) seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities between seven and ten years. Apa itu Zero Coupon Bonds? - InvestBro Zero coupon bonds (ZCB) adalah jenis obligasi yang tidak membayarkan fixed coupon-nya. Investor bisa membeli zero coupond bonds dengan harga diskon dan ketika tanggal jatuh tempo obligasi tersebut tiba, investor akan dibayar sesuai dengan harga nominalnya (face value). Maka dari itu, obligasi ini juga disebut deep discount bonds .

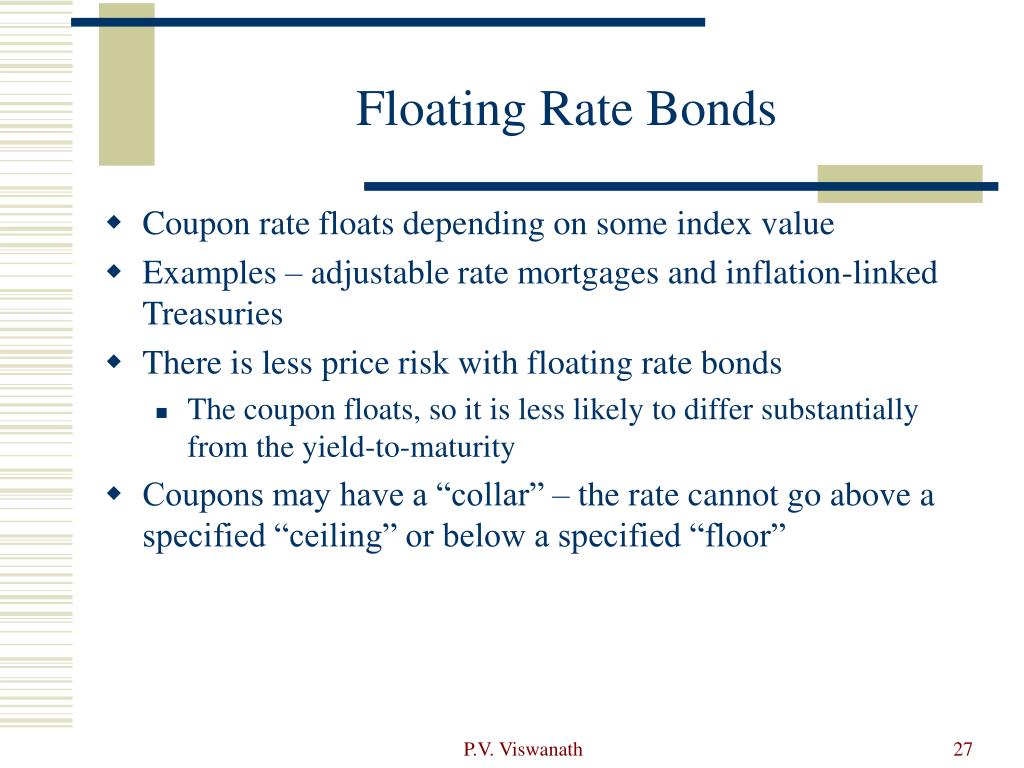

Evolution of debt market in India - Notes Study For the shorter term, there are Treasury Bills or T-Bills, which are issued by the RBI for 91 days, 182 days, and 364 days; Corporate Bonds. ... Zero Coupon bonds 2. Coupon-bearing bonds 3. Treasury bills 4. Floating rate bonds 5. STRIPs 1. Coupon-bearing bond: Public sectors bonds: US30Y: U.S. 30 Year Treasury - Stock Price, Quote and News - CNBC Coupon 2.875% Maturity 2052-05-15 Latest On U.S. 30 Year Treasury Treasury yields fall to start August on signs that inflation may be cooling August 1, 2022CNBC.com 10-year Treasury yield is little... 3-Month Treasury Bill Secondary Market Rate, Discount Basis Categories > Money, Banking, & Finance > Interest Rates > Treasury Bills 3-Month Treasury Bill Secondary Market Rate, Discount Basis (TB3MS) Jul 2022: 2.23 | Percent | Monthly | Updated: Aug 1, 2022 Current Rates | Edward Jones U.S. Treasury Bills, Notes and Bonds YTM (%) 3-Month: 1.89%: 6-Month: 2.57%: 2-Year: 3.05%: 5-Year: 2.86%: 10-Year: 2.76%: 30-Year: 3.07%: These are exempt from state income tax and backed as to the timely payment of principal and interest. All rates expressed as yield to maturity as of 8/11/2022 unless otherwise indicated. Yield and market ...

› treasury-bills-vs-bondsTreasury Bills vs Bonds | Top 5 Best Differences (With ... Let us Discussed some of the major differences between Treasury Bills vs Bonds: Treasury bills are short term money market instruments whereas Treasury Bonds are long term capital market instruments. Treasury bills are issued at a discounted price whereas Treasury Bonds pay interest every six months to holders of a bond. Treasury bills mature ...

What Is a Zero Coupon Yield Curve? - Smart Capital Mind It is possible to use a Treasury bill that is close to maturity as an equivalent of a zero coupon bond and to use the yield on this bond to compute the yield curve. At any particular time, the interest rate that may be paid on a financial instrument depends on the term of the investment.

Long Term Government Bond ETF List - ETF Database Long Term Government Bond ETFs provide investors with exposure to the long side of the U.S. bond market. These funds focus on debt sponsored by the U.S. government or its agencies and can include Treasuries, MBS, TIPS or other debt. Long-term bonds generally have maturities longer than 10 years.

2 Year Treasury Note Rate Constant Maturity - Bankrate Two-Year Treasury Constant Maturity. 3.28. 3.23. 0.24. What it means: An index published by the Federal Reserve Board based on the average yield of a range of Treasury securities, all adjusted to ...

U.S. Treasury Bonds (T-Bonds): What They Are and How to Buy Investors in longer-term Treasurys (notes, bonds and TIPS) receive a fixed rate of interest, called a coupon, every six months until maturity, upon which they receive the face value of the bond....

What are the Risks of Investing in Treasury Bonds? - Investopedia Key Takeaways There is virtually zero risk that you will lose principal by investing in T-bonds. There is a risk that you could have earned better money elsewhere. Investing decisions are always a...

Egypt's central bank issues LE 31B in T-bills Thursday The plan also includes offering five "Zero Coupon" bonds with terms of 1.5 years worth LE 36 billion, three bids for three years, worth LE 11.5 billion, and two 5-year bids worth LE 2 billion. ... According to the latest report published by the ministry on its website, the volume of outstanding balances of treasury bills until the end of ...

SGS Bonds: Information for Individuals - Monetary Authority of Singapore Singapore Government Securities (SGS) bonds pay a fixed rate of interest and have maturities ranging from 2 to 30 years. There are three categories of SGS bonds - SGS (Market Development), SGS (Infrastructure) and Green SGS (Infrastructure). Auction Updates 27 Jul 2022 Closed NX22100W 10-Year SGS (Market Development) (New) 29 Aug 2022 Upcoming

What Is a Zero-Coupon Bond? Definition, Advantages, Risks In 2018, for example, a 10-year Treasury zero was yielding as much as an annualized 3.1%, while 10-year T-notes were at 0.2%. As of November 2020, the current yield-to-maturity rate on the PIMCO...

Treasury Bond Quotes | US Treasury Bond Rates | FinancialContent ... Bonds and Rates. Maturity Price Change Yield Change; US Treasury News ... Lendzero Launches its pre-negotiated, zero-haggle Business Funding Program. August 10, 2022. Via Press Release Distribution Service. ... Pearl Congratulates U.S. Senate on Historic Climate Bill. August 09, 2022. Via Newswire.com.

Treasury Rates, Interest Rates, Yields - Barchart.com The difference between bills, notes and bonds are the length until maturity. Treasury bills (or T-Bills) mature in one year or less. Like zero-coupon bonds, they do not pay interest prior to maturity; instead they are sold at a discount of the par value to create a positive yield to maturity. Many regard Treasury bills as the least risky ...

Pakistan Government Bonds - Yields Curve COUNTRY • PAKISTAN. Last Update: 15 Aug 2022 2:15 GMT+0. The Pakistan 10Y Government Bond has a 13.178% yield. Central Bank Rate is 15.00% (last modification in July 2022). The Pakistan credit rating is B-, according to Standard & Poor's agency. Current 5-Years Credit Default Swap quotation is 505.92 and implied probability of default is 8.43%.

Why are T-Bills used when determining risk-free rates? - Investopedia Since T-bills are paid at their par value over relatively short maturities and do not make regular interest rate payments (coupons), there is also virtually no interest rate risk while they are...

5 Year Treasury Rate - YCharts June 02, 2022. 2.92%. The 5 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 5 years. The 5 Year treasury yield is used as a reference point in valuing other securities, such as corporate bonds. The 5 year treasury yield is included on the longer end of the yield curve.

dailynewsegypt.com › 2022/08/02 › egypts-financeEgypt’s Finance Ministry plans to issue 35 bids for treasury ... Aug 02, 2022 · The plan also includes offering five Zero Coupon bonds with terms of one-and-a-half years worth EGP 36bn, three bids for three-year bonds worth EGP 11.5bn, and two five-year bids worth EGP 2bn.

Today's Prices - TreasuryDirect cusip security type rate maturity date call date buy sell end of day; 912796xm6: market based bill: 0.000%: 08/16/2022: 0.000000: 99.971111: 0.000000: 912796t41: market based bill

:max_bytes(150000):strip_icc()/one-thousand-dollar-series-i-savings-bond-56a091265f9b58eba4b1a116.gif)

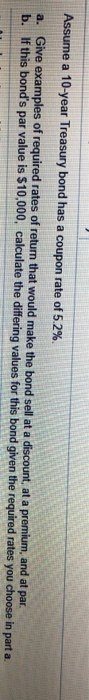

Post a Comment for "43 are treasury bills zero coupon bonds"