38 coupon rate vs ytm

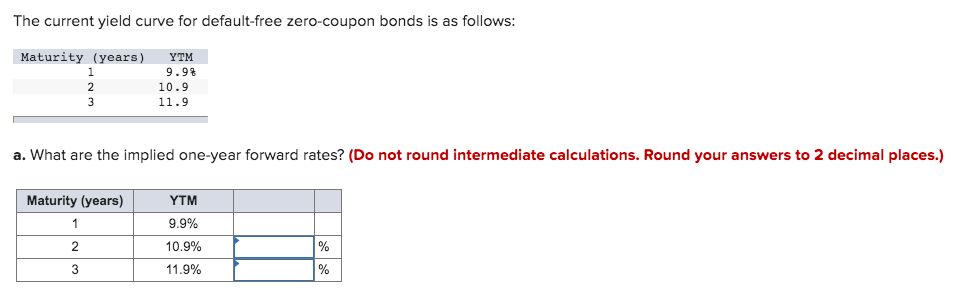

Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity Bond Yield | Nominal Yield vs Current Yield vs YTM Where P 0 is the current bond price, c is the annual coupon rate, m is the number of coupon payments per year, YTM is the yield to maturity, n is the number of years the bond has till maturity and F is the face value of the bond.. The above equation must be solved through hit-and-trial method, i.e. you plug-in different numbers till you get the right hand side of the equation equal to the left ...

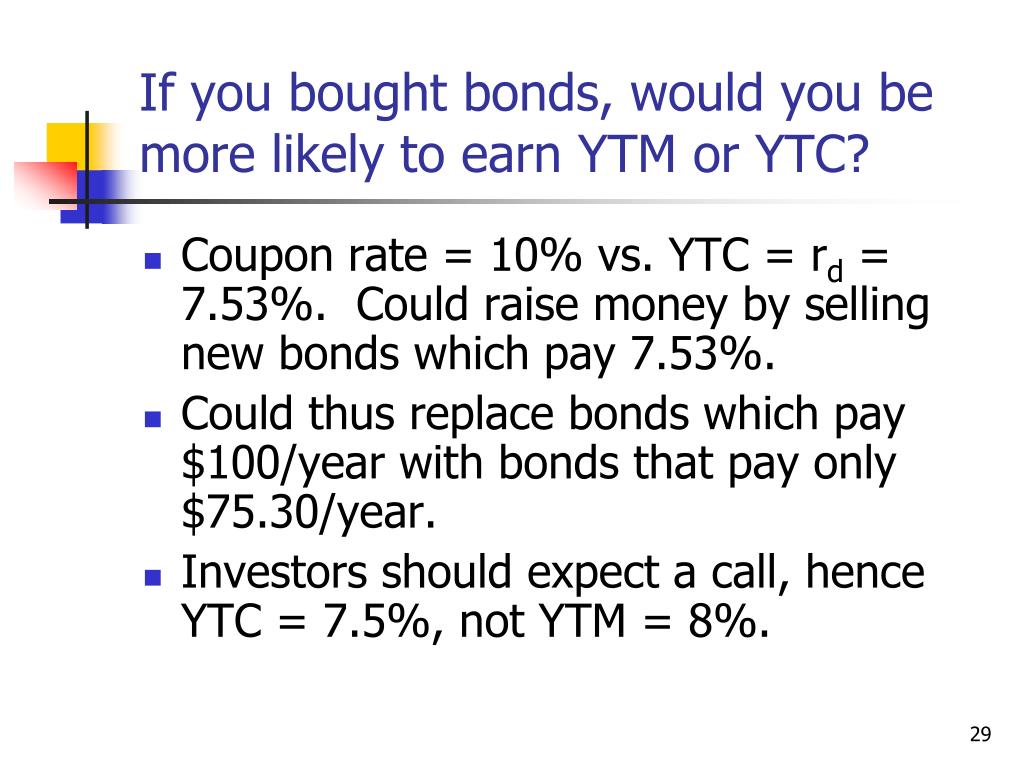

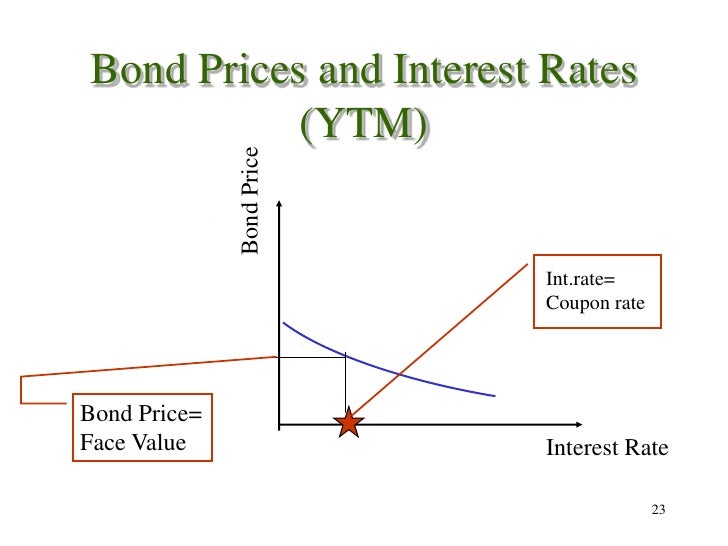

Important Differences Between Coupon and Yield to Maturity Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

Coupon rate vs ytm

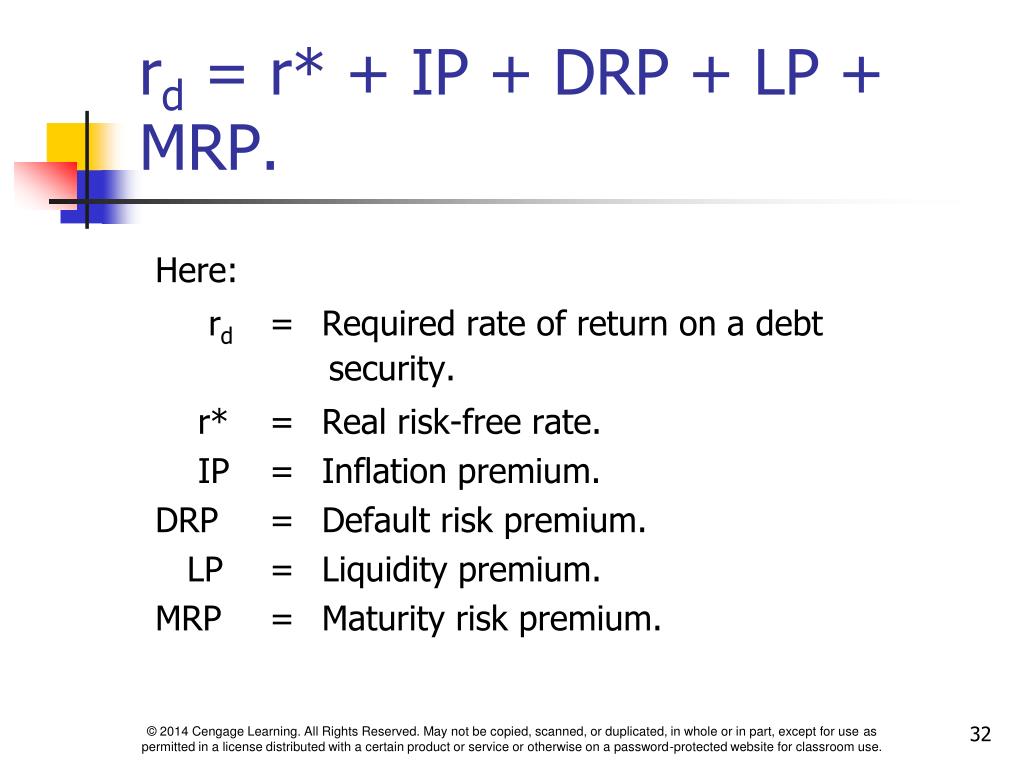

Coupon vs Yield | Top 8 Useful Differences (with Infographics) The coupon rate of a bond is the amount of interest that is actually paid on the principal amount of the bond (at par). While yield to maturity defines that it's an investment that is held till the maturity date and the rate of return it will generate at the maturity date. What is the Difference Between YTM and Coupon rates ... 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Coupon Rate Vs YTM - YouTube Learn more about the difference between a coupon rate and a yield to maturity.Investor's Business Daily has been helping people invest smarter results by pro...

Coupon rate vs ytm. What Is Coupon Rate and How Do You Calculate It ... Yield to Maturity - YTM vs. Spot Rate: What's the Difference? For instance, if a bond with a face value of $1,000 presents a coupon rate of 5%, then the bond pays $50 to the bondholder until its maturity. Difference Between Current Yield and Coupon Rate (With ... Current Yield vs Coupon Rate. The main difference between current yield and coupon rate is that current yield is a ratio of annual income from the bond to the current price of the bond, and it tells about the expected income generated from the bond. Current Yield vs. Yield to Maturity - Investopedia Dec 13, 2021 · The YTM formula is a more complicated calculation that renders the total amount of return generated by a bond based on its par value, purchase price, duration, coupon rate, and the power of ... Difference Between Coupon Rate and Yield to Maturity (With ... The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year.

Duration vs. Maturity and Why the Difference Matters Sep 01, 2017 · See the diagram below to understand the relationship between the bond’s price and its interest rate (or coupon rate). A bond is quoted with its “coupon yield”. This refers to the annual interest payable as a percent of the original face or par value. An 8% bond with a par value of 1000 would receive $80 per year. Coupon/Interest Rate= 8% ... Difference Between Coupon Rate And Yield Of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion Yield to Maturity vs. Coupon Rate: What's the Difference? The coupon rate is the annual income an investor can expect to receive while holding a particular bond. At the time it is purchased, a bond's yield to maturity and its coupon rate are the same.... Difference Between YTM and Coupon rates 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author Recent Posts Ian Search DifferenceBetween.net : Help us improve.

Yield to Worst (YTW): Formula and Bond Excel Calculator Coupon Rate: 6%. Annual Coupon: $60. Now, we'll enter our assumptions into the Excel formula from earlier to calculate the yield to maturity (YTM): Yield to Maturity (YTM): "= YIELD (12/31/2021, 12/31/2031, 6%, Bond Quote, 100, 1)". By contrast, the YTC switches the "maturity" to the first call date and "redemption" to the call ... Equity vs Fixed Income - A Side by Side Comparison The yield-to-maturity (YTM), is the single discount rate that matches the present value of the bond’s cash flows to the bond’s price. YTM is best used as an alternative way to quote a bond’s price. For a bond with annual coupon rate c% and T years to maturity, the YTM (y) is given by: Coupon Rate vs Current Yield vs Yield to Maturity (YTM ... In this lesson, we explain the coupon rate, current yield, and yield to maturity (YTM). We go through the coupon rate formula, current yield formula, and the... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Yield to Maturity vs Coupon Rate: What's the Difference ... If you purchase the bond at face value, the YTM and the coupon rate are the same. Otherwise, the YTM increases or decreases depending on whether you've purchased a discount or premium bond. Compare the Yield to Maturity vs Coupon Rate Before Purchasing Bond. Investing your money is not an action you should take lightly.

New Investor's Guide to Premium and Discount Bonds Oct 31, 2021 · A bond trades at a premium when its coupon rate is higher than the prevailing interest rates. A bond trades at a discount when its coupon rate is lower than the prevailing interest rates. Using the previous example of a bond with a par value of $1,000, the bond's price would need to fall to $750 to yield 4%, while at par, it yields 3%.

Coupon Rate - Meaning, Calculation and Importance The main distinction between the coupon rate and YTM is the return estimation. The coupon rate payments are the same for the bond tenure. While the yield on maturity varies depending on various factors such as the number of years till maturity and the current trading price of the bond. Let's assume the couponrate for a bond is 15%.

Bond Basics: Issue Size and Date, Maturity Value, Coupon Jan 02, 2022 · Coupon and Yield to Maturity . The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures.

Coupon vs Yield | Top 5 Differences (with Infographics) coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held …

Coupon Rate vs Yield to Maturity - StockMarketBox The main difference between yield to maturity and coupon rate is that the coupon rates remain the same throughout the term of the bond. The yield to maturity changes depending on many factors, such as the remaining years until maturity and the current bond price. Another example illustrates the distinction between yield to maturity and coupon rate.

Yield to Maturity (YTM): Formula and Excel Calculator An important distinction between a bond's YTM and its coupon rate is the YTM fluctuates over time based on the prevailing interest rate environment, whereas the coupon rate is fixed. Yield to Maturity (YTM) and Coupon Rate / Current Yield If the YTM < Coupon Rate and Current Yield → The bond is being sold at a "premium" to its par value.

Yield to Maturity vs Coupon Rate - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Coupon rate is a fixed value in relation to the face value of a bond. If yield to maturity is greater than the coupon rate, the bond is trading at a discount to its par value.

Coupon Rate Calculator | Bond Coupon Jan 12, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

Coupon Rate Definition Sep 05, 2021 · This is the effective return called yield to maturity (YTM). For example, a bond with a par value of $100 but traded at $90 gives the buyer a yield to maturity higher than the coupon rate.

Coupon Rate Vs YTM - YouTube Learn more about the difference between a coupon rate and a yield to maturity.Investor's Business Daily has been helping people invest smarter results by pro...

What is the Difference Between YTM and Coupon rates ... 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation.

Coupon vs Yield | Top 8 Useful Differences (with Infographics) The coupon rate of a bond is the amount of interest that is actually paid on the principal amount of the bond (at par). While yield to maturity defines that it's an investment that is held till the maturity date and the rate of return it will generate at the maturity date.

:max_bytes(150000):strip_icc()/GettyImages-585782658-a8674d8e40604230a908e765a055f313.jpg)

Post a Comment for "38 coupon rate vs ytm"